Using face verification on OCBC Bank ATMs is account balance enquiries.

The introduction of facial biometrics for ATM services by OCBC Bank takes Singapore closer to eliminating the need to carry around an ATM card, which can be skimmed or stolen.

The first transaction which can be performed using face verification on OCBC Bank ATMs is account balance enquiries, which will be first rolled out on eight ATMs around Singapore.

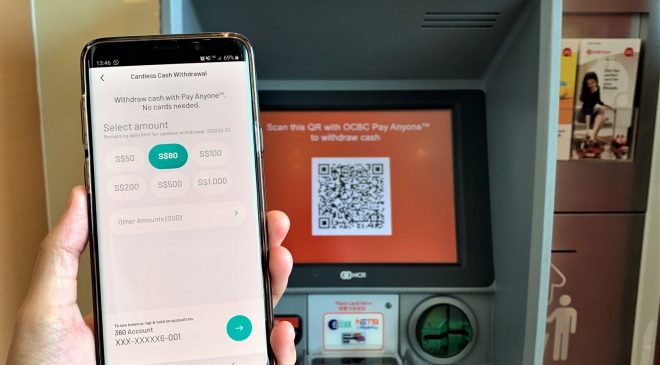

OCBC Bank will extend face verification for cash withdrawals to all OCBC Bank ATMs in Singapore progressively. This latest innovation comes after the nation’s first and only rollout of QR code cash withdrawals in July 2019.

Account balance enquiries and cash withdrawals are the most used ATM services, making up close to 8 in 10 of all ATM transactions performed by OCBC Bank customers. Thus, to provide added convenience to customers accessing high-touch ATM services, OCBC Bank is the first to tap Singapore’s National Digital Identity infrastructure, SingPass Face Verification, to securely verify customers for banking transactions at ATMs without the need for ATM cards. A customer’s scanned face is matched and verified against Singapore’s national biometric database containing the images and identities of 4 million Singapore residents.

This convenient access to ATM banking services is a secure alternative to using physical ATM cards. Face verification is embedded with security features to prevent fraud, including liveness-detection technology that detects and blocks the use of photographs, videos, or masks during the verification process, said Sunny Quek head of consumer financial services Singapore at OCBC Bank.

“Singapore consumers are keen digital adopters – even the elderly. While cash is still a key mode of payment in Singapore, the digital overlay to get cash is very welcomed by consumers,” he said. Overall, digital adoption within OCBC has grown year-on-year in 2020 with more than 40 per cent more customers signed up on PayNow, and PayNow transactions doubling, compared to 2019. QR code cash withdrawals at ATMs grew 88 per cent year-on-year in 2020. With many customers already embracing QR cash withdrawals without having to use an ATM card, face verification will add a layer of convenience to more customers as they access our banking touchpoints.”

Digitalising ATM services with face verification

Despite the significant increase in digital banking adoption among OCBC Bank customers, with more than 200,000 digital ‘debutantes’ making their first digital banking transactions in 2020, ATM usage remains high with more than two million cash withdrawals monthly.

OCBC Bank leveraged the National Digital Identity infrastructure in July 2020 to introduce an alternative digital login using customers’ SingPass to access digital banking services. This eliminates the need for customers to remember multiple access codes and PINs, and benefits customers who do not use fingerprint or facial biometrics. Within six months, more than one million logins to OCBC Bank’s digital banking platforms were performed using SingPass, in place of traditional access codes and PINs.

Recently Singapore’s Government Technology Agency (GovTech) announced it has refreshed Singpass brand identity, the first in 18 years, with a new logo that marks its evolution of becoming Singapore’s trusted national digital identity.

As of March 2021 Singpass, will offer residents greater convenience and accessibility when transacting with the Government and private sector, both online and in person.

In the last three years, more than 10 features have been added to Singpass.

From the introduction of the Singpass app in October 2018 to new features such as Digital IC, Face Verification and digital signing, Singpass has been evolving and now powers more than 1,400 services offered by over 340 public and private sector organisations. Its user base has also grown significantly.

Businesses and agencies can tap on Singpass’ application programming interfaces (APIs) to enable access or create new value-added services for Singapore residents. The open APIs can be easily integrated with services of organisations, big or small, to enhance customer experiences and improve business efficiency. For example, the use of Singpass for customer logins removes the need for organisations to maintain their own authentication platforms and users can avoid the hassle of managing many different sets of credentials.